"Legal opinion on the requirements for registration of ship mortgages in Panama: case study of the Panamanian vessels Caballo Maya and Caballo Marango"

Opinión jurídica sobre los requisitos para el registro de hipotecas navales en Panamá: estudio de caso de los buques panameños Caballo Maya y Caballo Marango.

Por: Mosquera T, Margareth J.

Universidad de Panamá

Facultad de Derecho y Ciencias Políticas

Departamento de Derecho Privado

Panamá

Correo: margareth.mosquera@up.ac.pa

ORCID: https://orcid.org/0009-0008-0585-1441

Entregado: 1 de octubre de 2024

Aprobado: 19 de febrero de 2025

DOI https://doi.org/10.48204/j.aderecho.n55.a8728

EXTRACTO:

Este documento emite una opinión legal sobre las hipotecas navales de las embarcaciones CABALLO MARANGO y CABALLO MAYA en Panamá. Ambas embarcaciones están debidamente registradas bajo las leyes panameñas, y las hipotecas se ejecutaron conforme a la normativa vigente, cumpliendo con los requisitos del Artículo 260 de la Ley Marítima Comercial de Panamá. Las certificaciones emitidas en mayo y junio de 2020 por el PRPV respaldan la validez y ejecutabilidad de dichas hipotecas, las cuales vinculan a terceros.

Las hipotecas son válidas según el Artículo 1595 del Código Civil de Panamá y su cancelación solo puede ocurrir en circunstancias limitadas. Además, no es necesario incluir detalles de pagos o lista de incumplimientos para su validez. El registro de las hipotecas ante la Autoridad Marítima de Panamá garantiza su legalidad, y las reclamaciones de terceros -distintas a créditos marítimos privilegiados de orden jerárquico superior a la hipoteca naval- son consideradas inferiores a las hipotecas registradas.

ABSTRACT:

This paper provides a legal opinion on the naval mortgages of the vessels CABALLO MARANGO and CABALLO MAYA in Panama. Both vessels are duly registered under Panamanian law, and the mortgages were executed in accordance with the applicable regulations, complying with the requirements of Article 260 of the Panamanian Maritime Commercial Law. The certifications issued in May and June 2020 by the PRPV confirm the validity and enforceability of these mortgages, which are binding on third parties.

The mortgages are valid under Article 1595 of the Panamanian Civil Code, and their cancellation can only occur in limited circumstances. Furthermore, it is not necessary to include payment schedules or a list of defaults for their validity. The registration of the mortgages with the Panama Maritime Authority guarantees their legality, and any claims from third parties —other than privileged maritime liens with a higher ranking than the naval mortgage— are considered subordinate to the registered mortgages.

Palabras claves: naves, hipoteca naval, derecho marítimo, créditos marítimos privilegiados.

Keywords: vessels, naval mortgage, maritime law, maritime liens.

Introduction

The present legal opinion is seeking to answer - from the Panamanian law perspective - the following questions:

- What are the minimum mandatory requirements for a Panamanian ship mortgage to be binding on the parties to the ship mortgage and on third parties?

- What is the procedure for registering a ship mortgage in Panama?

- What are the legal effects generated after a ship mortgage registration takes place?

In connection with this legal opinion, we have examined the following:

a. Articles of Incorporation of Marfield Limited, Inc. and Shanara Maritime

International, S.A. and amendments.

b. Public deeds of the respective titles of ownership registered over the Vessels.

c. Public deeds of each of the mortgages registered against the Vessels.

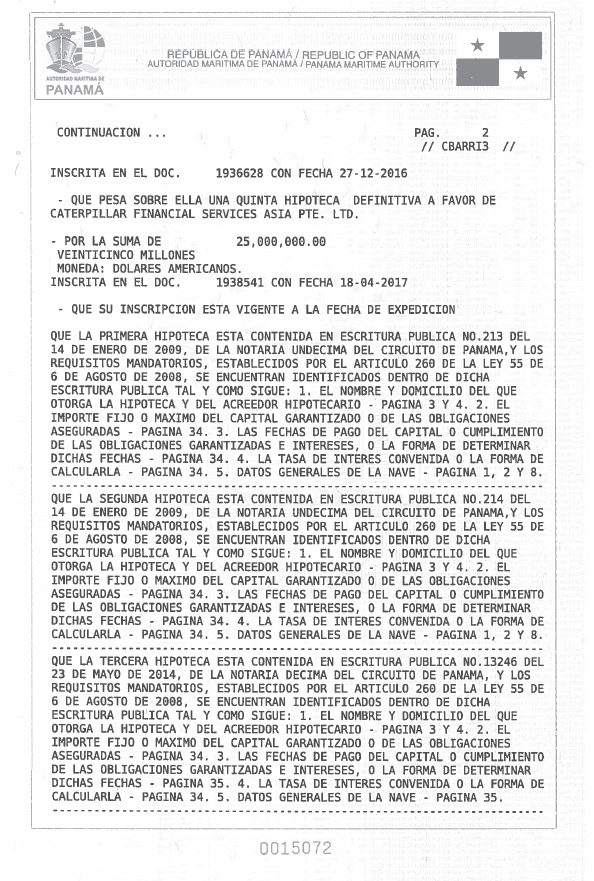

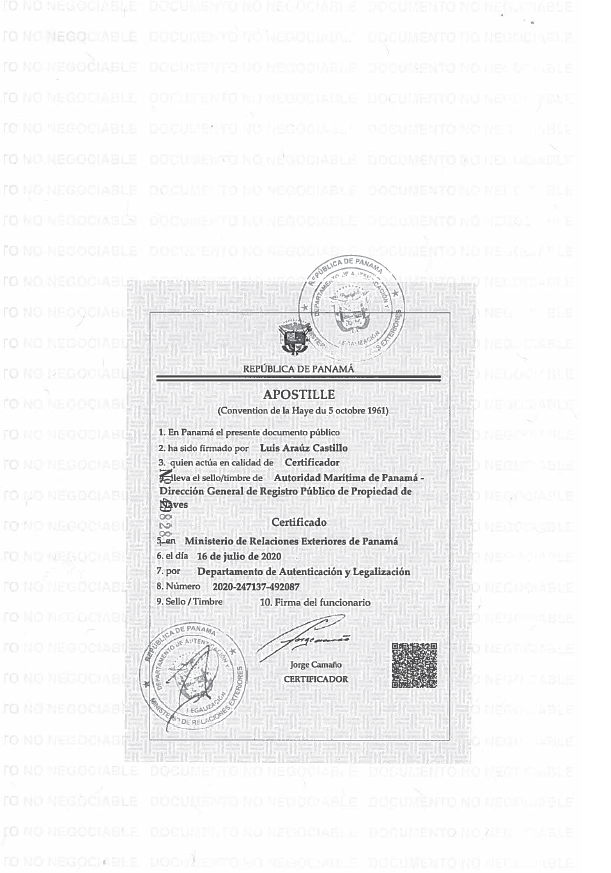

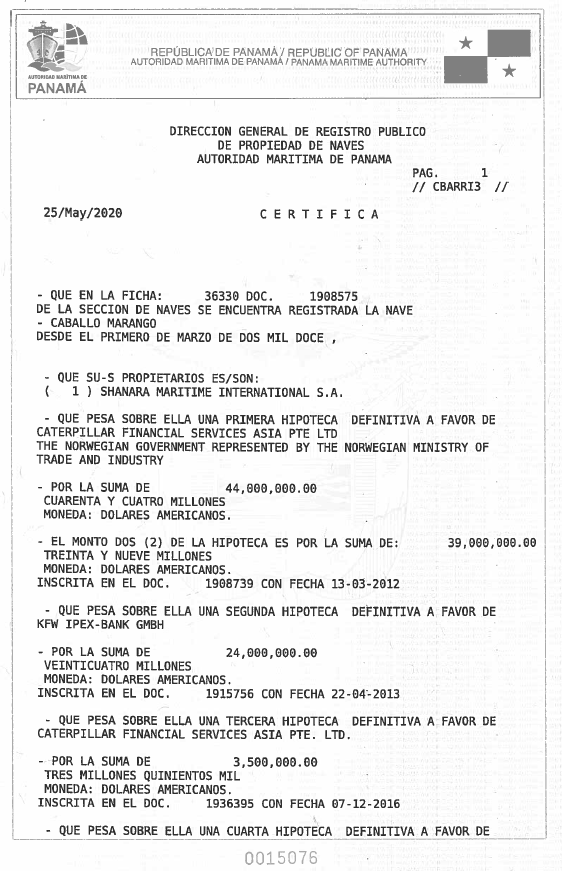

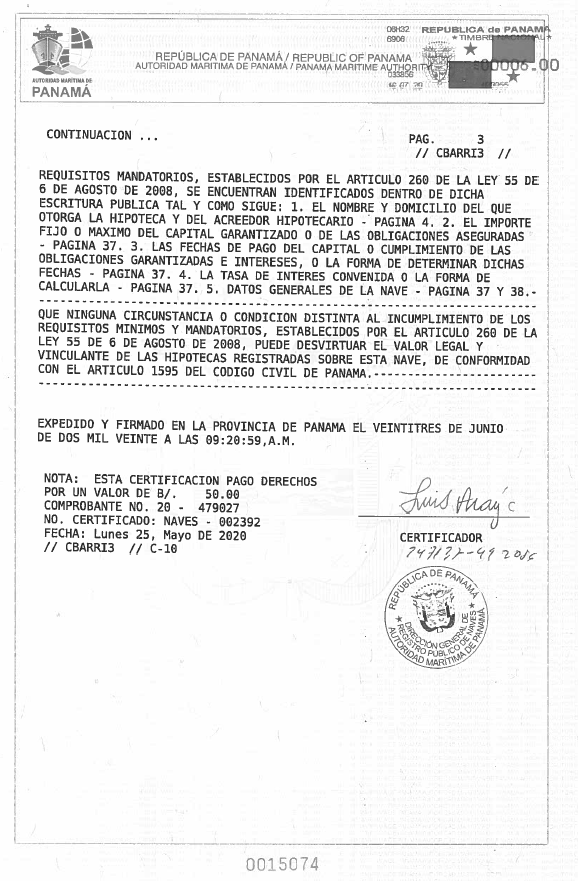

d. The Panama Maritime Authority PRPV (as defined below) Certificate for the Caballo Marango dated 25 May 2020 attached in Annex 1.

e. The Panama Maritime Authority PRPV (as defined below) Certificate for the Caballo Maya dated 19 June 2020 attached in Annex 2.

We have also examined such other corporate records and documents and certificates of public officials, made such investigations and searches, and considered such questions of law as we have considered necessary to give the opinions expressed in this legal opinion.

For the sake of good order, we will answer the above questions separately. Thereafter, we will refer to each of the ship mortgages registered against the Panamanian vessels CABALLO MARANGO – IMO No. 9526382 and CABALLO MAYA – IMO No.

9453341 (together the “Vessels”), as they are under arrest by the Plaintiff’s request in the Civil Action.

This legal opinion will also include comments on whether the mortgagees of the Panamanian ship mortgages registered against the Vessels are entitled to enforce each of the mortgages in their favour and their ranking with respect to the claims asserted by Grupo R.

I. What are the minimum mandatory requirements for a Panamanian ship mortgage to be binding on the parties to the ship mortgage and third parties?

1. Articles 249 to 277 of Law No. 55 of 6th August, 2008 of the Republic of Panama (the “Commercial Maritime Law of Panama”) refer specifically to Ship Mortgages granted on Panamanian registered vessels. Reference is made therein to the provisions of the Civil Code on Mortgages on Immovables (Real Estate) and these provisions apply to the extent that they do not contradict the special provisions of the Commercial Maritime Law of Panama. Therefore, the Commercial Maritime Law of Panama governs all aspects of Panamanian ship mortgages, including but not limited to, the requirements and procedures for their registration with the Directorate General of Public Registry of Property of Vessels of the Panama Maritime Authority (the “PRPV”), the central office charged with registration of titles to Panama vessels, and ship mortgages recorded thereon.

2. As a complementary explanation of the internal structure of the Panama Maritime Authority (PMA), please note that the PMA is the highest authority overseeing the shipping interests of the Republic of Panama, including the Panamanian Ship Registry. The PMA has the status of Ministry of Maritime Affairs and comprises four operating Directorates, to wit:

· The Directorate General of Merchant Marine is in charge of the ship registration process and related matters;

· The Directorate General of Seafarers is responsible to issue seafarers certifications and to comply with the provisions of international seafarer conventions;

· The Directorate General of Public Registry of Property of Vessels of the Panama Maritime Authority (the “PRPV”) is responsible for the registration of ownership titles/property titles, ship mortgages and other kinds of registered encumbrances against Panamanian vessels; and

· The Directorate General of Ports and Ancillary Maritime Industries handles all the matters, licenses and permission related to ports and ancillary maritime industries.

3. In terms of mandatory requirements to be fulfilled by a Panamanian ship mortgage, Article 260 of the Commercial Maritime Law1 provides that the ship mortgage may be executed in any language and should be in writing through a (i) private document or a (ii) public deed, or may be executed according to the formalities of the laws of the place of execution. For the purposes of its final registration at the PRPV, the document must be translated into Spanish and protocolized into a Public Deed through a Notary Public in Panama.

4. In the case that the ship mortgage is executed in a private document outside of the Republic of Panama, the same must be notarized by way of an acknowledgment of the legal capacity of the signatories and the authenticity of the signatures thereof. Thereafter, the Notary's signature must be legalized by a Panamanian Consul or by way of Apostille.

5. While a ship mortgage may include additional provisions, it must contain the following requirements as prescribed by Article 260 of the Commercial Maritime Law (the fully translated text of Article 260 is attached as Annex 3, and the requirements are summarized in the Panama Maritime Authority Merchant Marine Circular MMC-11, to wit:

a. The name and domicile of the party granting the mortgage (the mortgagor) and of the party secured by the mortgage (the mortgagee).

b. The fixed or maximum amount secured by the ship mortgage. The ship mortgage is deemed to secure, in addition to principal, all of the accrued interest, judicial costs, collection expenses, amounts arising from fluctuations of currency or of other means of payment, and all other sums stated in the ship mortgage.

It is presumed, both between the parties and with respect to third persons, unless there is evidence to the contrary, that the sums owed by the mortgagor, be it in respect of principal, interest or other sums, are secured by the ship mortgage.

c. The dates of repayment of principal and interest, or the manner to determine such dates, unless the ship mortgage is executed to secure obligations due on demand, future obligations, or obligations subject to a condition precedent.

d. To the extent applicable, the parties must determine in the ship mortgage the interest rate or the manner in which to calculate the interest rate.

Among others, the interest rate may be stipulated to by referencing the prevailing rate in a determined market or to the bank rate granted to selected borrowers in any market.

The interest rate may be stipulated by reference to the rate existing at the time of execution of the ship mortgage, or in accordance with the fluctuations which it may undergo within the term of the contract. The sums secured by a ship mortgage are not subject to a maximum interest rate.

e. The name of the ship, number of the Navigation Patente also known as registration number (provisional or statutory), call sign, and registered dimensions and tonnages; and

f. If several vessels are mortgaged to secure a single credit, the amount or part of the mortgage for which each vessel is liable may be stated. If said statement has not been made, the creditor can collect the totality of the sum secured by the ship mortgage from any of the vessels or from all of them.

6. The requirements mentioned in point 4(c) (i.e. the dates of repayment of principal) and 4(d) (i.e. interest) may be included in the ship mortgage or in extracts, contracts, exhibits, or schedules thereto.

In the event that the ship mortgage is executed as security for a specified and described credit or one whose amount may not be determined at the time of execution of the ship mortgage, it will suffice to mention the essential information which will allow the credit obligation to be identified and that a pre-determined limit be assigned to the amount of the mortgage liability.

a. Additionally, there is no need to set out a specific date or a schedule of payments in order for these requirements to be considered duly fulfilled in the ship mortgage, as the law expressly allows that as long as there is a way for the parties to determine the repayment date of the principal (also known as maturity date) and the interest rate, this will be accepted and in line with the minimum mandatory requirements indicated in Article 260 of the Commercial Maritime Law. In fact, it is a common practice in Panama to put phrases like: “the maturity date/repayment date will be determined in accordance to the terms of the Loan Agreement” or “The maturity date under this Mortgage is immediately on demand by the Mortgagee”, to refer to the methodology to determine the maturity date/repayment date.

7. To summarize the applicable law on ship mortgages in Panama, there are five (5) minimum requirements that a ship mortgage must contain to be effective:

(i) the name and domicile of the mortgagor and mortgagee; (ii) the maximum amount secured by the ship mortgage; (iii) the maturity date; (iv) the applicable interest rate or confirmation that no interest will be charged, if that is the case; and (v) full description of the vessel being mortgaged, including her name, call sign, tonnages and dimensions.

II. What is the procedure for a ship mortgage registration in Panama?

8. Article 7 of the Commercial Maritime Law of Panama states that all titles of ownership and encumbrances to be registered against a Panamanian vessel must be lodged with the PRPV, which may be accomplished through any Merchant Marine Panamanian Consulate abroad. For further clarification, please note the following quotation:

“Article 7: The ownership of the vessel or part of the ownership thereof will be transferred in the manner provided for in this law.

The requirement of the delivery or completion of ownership transfer may be complied with if the parties expressed in the contract that the ownership is transferred immediately to the buyer.

The seller will be obliged to deliver to the buyer, in the act of the contract, certification of the registration of the ship in the Public Registry until the date of the sale.

Titles of ownership of vessels and their encumbrances subject to registration may only be submitted for registration at the Panama Public Registry in accordance with the provisions established in this law.”

9. Once the title of ownership of a vessel to be mortgaged has been preliminarily registered at PRPV, a preliminary mortgage may thereafter be recorded on the vessel even though title thereto has not been permanently registered at said directorate. Upon permanent registration of the title of ownership thereto at the PRPV, the mortgagee will cause the mortgage to be permanently registered at the PRPV .

10. To register a mortgage against a Panamanian vessel, it is mandatory that a title of ownership over the referred vessel must be registered first or at least, simultaneously with the ship mortgage. For this purpose, the PRPV contemplates the following two (2) procedures:

a. Preliminary registration (Article 9 of the Commercial Maritime Law): this type of registration may be made through Panamanian Consulates abroad or locally in Panama and will be effective for a six (6) month period from the date of preliminary registration. Therefore, it grants the mortgagee the same rights of the permanent registration for a period of six (6) months from the date it was effected, pursuant Article 10 of the Commercial Maritime Law.

The purpose of this registration is to grant an immediate security over the vessel, and it was devised specifically for interested parties that are in a different time zone from Panama and require that the mortgage registration be completed outside the Republic of Panama and outside business hours.

If arranged through a Consulate, the Consulate will provide a simple form that needs to be completed with basic information regarding the mortgage contract and the vessel and will collect the registration fees. Thereafter, the Consulate will send the application to the PRPV that in turn will review the documents and confirm the registration particulars to the Consulate to enable them to issue a Certificate of Preliminary Registration.

If arranged locally, the form will be completed by the law firm designated by the parties and the registration will be paid directly to the Panama Maritime Authority.

The preliminary registration is optional. In case the parties proceed this way, it must be pointed out that the same must be followed by the permanent registration within six (6) months, as described above.

b. Permanent registration: this registration is mandatory and may only be arranged in Panama by the designated Panamanian law firm. For this purpose, it is necessary to arrange the translation of the ship mortgage into Spanish and the preparation of a public deed with the Spanish translation text of the mortgage by a local Notary Public.

It is also possible to arrange the registration of the ship mortgage in the English language, provided that an Extract of the Mortgage is also executed by the mortgagor and the mortgagee, in which case only the Extract of Mortgage would need to be translated into Spanish. This method significantly reduces the time required to complete the permanent registration in the

Republic of Panama.

11. From the PRPV perspective, in the event that a ship mortgage to be registered at PRPV, whether preliminary or permanent, does not meet the minimum mandatory requirements above indicated, the ship mortgage will be rejected by the PRPV. Consequently, a ship mortgage registration will not be completed until the interested parties amend the deficiencies identified by the PRPV and re-lodge the public deed duly amended. This is a key point of the ship mortgage registration process, which differentiates Panama from other flag registries.

12. Consequently, a mortgage that has been accepted by the PRPV has been reviewed by the PRPV and deemed valid by the PRPV as of the date of recordation. Certificates confirming the acceptance and approval of the mortgages over the Vessels were obtained from the PRPV, and are attached in Annexes No. 1 & 2.

13. Moreover, the only Panamanian authority that has the power to declare that a title of ownership or a ship mortgage to be registered against a Panamanian vessel is defective is the PRPV. No private entity nor any individual, including but not limited to private Panamanian lawyers, law firms, companies, etc., are able to declare a document that has already been registered by the PRPV to be defective.

III. What are the legal effects generated after a ship mortgage registration takes place?

14. Every mortgage registered against a Panamanian vessel is considered by the Panamanian law (the Law of the Flag) to be a maritime lien. Therefore, every mortgagee of a Panamanian vessel is entitled to enforce the ship mortgage against the respective vessel.

15. The order of maritime liens in the Republic of Panama up to the mortgage rank as established by Article 244 of the Commercial Maritime Law of Panama, is as follows:

a. Judicial costs incurred in the common interests of the maritime creditors;

b. Expenditures, indemnities and salaries for assistance and salvage due for the last voyage;

c. Salaries, payments and indemnities due to the Master and members of the crew for the last voyage;

d. Ship mortgages;

e. ………..

16. Pursuant to Article 244 of the Commercial Maritime Law of Panama, the mortgages recorded on the CABALLO MAYA and the CABALLO MARANGO discussed below were duly executed and registered with the PRPV under the laws

of Panama and are superior to the claims asserted against the vessels by Grupo R.

17. Article 4 of the Commercial Maritime Law of Panama provides the right of the creditors, including but not limited to the mortgagees, to pursue the vessel as she is considered affected and liable of the debts of her owner, whether they are common or privileged (i.e. maritime liens), and until the debts are paid in full by the vessel owner. For better reference, please note the following quotation:

“Article 4: Vessels will be subject to payment of the debts of their owner, be they common or privileged, and creditors will have the right to pursue them even if they are in the possession of third parties while their liability is in effect.”

IV. Legal status of the registered owners of the Vessels and their respective mortgages registered at the PRPV

m/v CABALLO MARANGO – IMO No. 9526382

18. The vessel CABALLO MARANGO is registered at the PRPV, under the ownership of SHANARA MARITIME INTERNATIONAL S.A., as per the information recorded at Microjacket: 36330, Document: 1908575 of the Shipping Section of the PRPV, as of March 1st, 2012.

19. There is a First Mortgage permanently registered against the CABALLO MARANGO in favour of CATERPILLAR FINANCIAL SERVICES ASIA PTE LTD and THE NORWEGIAN GOVERNMENT REPRESENTED BY THE NORWEGIAN MINISTRY OF TRADE AND INDUSTRY, in the split sum of US$44,000,000.00 - FORTY FOUR MILLION U.S. DOLLARS and US$39,000,000.00 - THIRTY NINE MILLION U.S. DOLLARS, duly registered

at Document: 1908739, as of March, 13th, 2012.

20. There is a Second Mortgage permanently registered against the CABALLO MARANGO in favour of KFW IPEX-BANK GMBH, in the sum of US$24,000,000.00 - TWENTY FOUR MILLION U.S. DOLLARS, duly

registered at Document: 1915756, as of April 22nd, 2013.

21. There is a Third Mortgage permanently registered against the CABALLO MARANGO in favour of CATERPILLAR FINANCIAL SERVICES ASIA PTE. LTD., in the sum of US$3,500,000.00 - THREE MILLION FIVE HUNDRED

THOUSAND U.S. DOLLARS, duly registered at Document: 1936395, as of December 7th, 2016.

22. There is a Fourth Mortgage permanently registered against the CABALLO MARANGO in favour of CATERPILLAR FINANCIAL SERVICES ASIA PTE. LTD., in the sum of 25,000,000.00 - TWENTY FIVE MILLION U.S.

DOLLARS, duly registered at Document: 1938542, as of April 18th, 2017.

m/v CABALLO MAYA – IMO No. 9453341

23. The vessel CABALLO MAYA is registered at the PRPV under the ownership of MARFIELD LTD. INC., as per the information recorded at Microjacket (registered number): 32387, Document: 1490811 of the Shipping Section of the PRPV, as of December 18th, 2008.

24. There is a First Mortgage, permanently registered against the CABALLO MAYA in favour of EKSPORTFINANS ASA, in the sum of US$44,000,000.00

- FORTY FOUR MILLION U.S. DOLLARS, duly registered at Document: 1510118, as of January 26th, 2009.

25. There is a Second Mortgage permanently registered against the CABALLO MAYA in favour of CATERPILLAR FINANCIAL SERVICES ASIA PTE. LTD., in the sum of US$33,240,000.00 -THIRTY THREE MILLION TWO HUNDRED FORTY THOUSAND U.S. DOLLARS., duly

registered at Document: 1510127, as of January 26th, 2009.

26. There is a Third Mortgage permanently registered against the CABALLO MAYA in favour of CATERPILLAR FINANCIAL SERVICES ASIA PTE LTD, in the sum of US$12,180,000.00 - TWELVE MILLION ONE HUNDRED

EIGHTY THOUSAND U.S. DOLLARS, duly registered at Document: 1922450, as of May 28th, 2014.

27. There is a Fourth Mortgage permanently registered against the CABALLO MAYA in favour of CATERPILLAR FINANCIAL SERVICES ASIA PTE. LTD., in the sum of US$3,500,000.00 - THREE MILLION FIVE HUNDRED

THOUSAND U.S. DOLLARS, duly registered at Document: 1936628, as of December 27th, 2016.

28. There is a Fifth Mortgage permanently registered against the CABALLO MAYA in favour of CATERPILLAR FINANCIAL SERVICES ASIA PTE. LTD., in the sum of US$25,000,000.00 - TWENTY FIVE MILLION U.S.

DOLLARS, duly registered at Document: 1938541, as of April 18th, 2017.

V. Conclusions

29. The vessels CABALLO MARANGO and CABALLO MAYA are documented under the laws of Panama with the PRPV. The abovementioned mortgages filed against the vessels CABALLO MARANGO and CABALLO MAYA were duly executed under the laws of Panama and duly registered under the laws of Panama with the PRPV, which is the central office charged with registration of ship mortgages.

30. The abovementioned mortgages against the vessels CABALLO MARANGO and CABALLO MAYA comply with all of the minimum mandatory requirements, established by Article 260 of the Commercial Maritime Law of Panama, as per the attached Certifications issued by the PRPV dated 25 May 2020 and 19 June 2020 (Annexes 1 & 2). Therefore, the ship mortgages are properly registered, enforceable against the Vessels, and are binding on third parties, including Grupo R.

31. The attached Certifications issued by the PRPV dated 25 May 2020 and 19 June 2020 (Annexes 1& 2) specifically confirm and identify – for each of the mortgages referenced above - all five minimum Panamanian requirements by page number. The Certifications also include the following statement:

“That no circumstance or condition different from the non- compliance with the minimum and mandatory requirements, as established by Article 260 of Law 55 of August 6th, 2008, could undermine the legal and binding value of the mortgages registered against this Vessel, in accordance with Article 1595 of the Civil Code of Panama”.

32. Therefore, as of May 25, 2020 and June 19, 2020, the PRPV has reviewed each of the mortgages on the Vessels, confirmed that each of the five minimum requirements are included therein, and recognizes the mortgages as valid and enforceable under Panama maritime law.

33. Under Panamanian law, it is not mandatory for the purpose of determining the validity of a Panamanian ship mortgage, or its ranking as a maritime lien, to include the schedule of mortgage payments or the list of events of default, or the addition of the loan agreement as part of the mortgage itself (or the like). The lack of these details does not invalidate the legal effect generated from a mortgage registration in Panama and under no circumstances could this be considered a sufficient reason to outrank or invalidate the related Panamanian ship mortgages.

34. If a deficiency had been noted by the PRPV at the time of registration, the PRPV would not have accepted the mortgages for registration. Following registration, if a defect in a mortgage is subsequently noted by the PRPV, the PRPV is not authorized to either correct errors/omissions or to unilaterally cancel the mortgage, as per Article 1784 of the Panama Civil Code. Therefore, the cancellation of a registered mortgage could only take place in very limited circumstances, which has been established in Article 1784 of the Panama Civil Code. For better reference, please note the following quotation of Article 1784 of the Panama Civil Code:

Article 1784: A registration shall not be cancelled except by virtue of judicial order or enforceable sentence or Public deed or authentic document in which the person in whose favour the registration has been made, or their successors in title or legitimate representative express their consent for the cancellation.

35. These mortgages are registered with the PRPV and therefore, they are in the public domain and available to third parties for examination. Additionally, all of the mandatory requirements that are expressly described in the Commercial Maritime Law of Panama, are also perfectly determinable in the content of these ship mortgages, even though the repayment dates were not specified in the format month-date-year. There is no need to set out a specific date or a schedule of payments in order for these requirements to be considered duly fulfilled in the ship mortgage, as the law expressly allows that as long as there is a way for the parties to determine the repayment date of the principal (also known as maturity

date) and the interest rate, this will be accepted and in line with the minimum mandatory requirements indicated in Article 260 of the Commercial Maritime Law. The parties included the methodology for determining the dates of repayment of principal and interest under the ship mortgages by including a reference to the related loan agreement in each of the ship mortgages.

36. Furthermore, it is necessary to take into account that all of the titles of ownership and ship mortgages referred to herein are currently duly registered at the PRPV, who recognizes them as valid and enforceable ship mortgages and cites each of the five (5) minimum criteria in the Certifications issued on 25 May 2020 and 19 June 2020. Therefore, PRPV, as the sole competent Panamanian authority, did not find these documents defective and consequently, they proceeded with their registration accordingly and recognize the mortgages as valid today.

37. Each of the abovementioned mortgages is indeed a maritime lien in favour of its mortgagees and against the mortgaged vessel, by command of the Commercial Maritime Law of Panama. The said condition, i.e. maritime lien, is acquired as of the mortgage registration at the PRPV, regardless of whether registration is preliminary or permanent. Based on this, the mortgagees are entitled to pursue the Vessels even if they are under the possession of a third party, which could be interpreted also as even if the vessels were under third parties control due to a judicial seizure.

38. For the reasons set forth above, the mortgages recorded against the CABALLO MARANGO and the CABALLO MAYA are valid and enforceable against the Vessels. Additionally, the claims asserted by Grupo R against the vessels in the Civil Action are inferior to the mortgages recorded against the CABALLO MARANGO and the CABALLO MAYA.

39. This opinion is limited to matters of the laws of the Republic of Panama as of the date hereof as currently applied by the Courts of Panama. We have not investigated, and we do not express or imply any opinions whatsoever with respect to the laws of any other jurisdiction or the effects thereof.

References:

ARROYO, I., (2002) Compendio de Derecho Marítimo, Tecnos, España.

ARROYO, I., (2001) Curso de Derecho Marítimo, J.M. Bosch Editor, Madrid.

BLAS SIMONE, O., (1993), Privilegios Marítimos e Hipoteca Naval, Depalma, Buenos Aires.

CHORLEY and GILES, (1962) Derecho Marítimo, traducción de Sánchez Calero. Barcelona.

ENRIQUEZ ROSAS, J., (19998), El Buque: una introducción al estudio jurídico de las embarcaciones, Instituto de Investigaciones Jurídicas, México.

GABALDÓN, J., (2006), Manual de Derecho de la Navegación Marítima, Marcial Pons, 3era. Edición, Barcelona.

Annex No. 1

Certifications issued by the PRPV, dated 25 May 2020 – CABALLO MARANGO

Annex No. 2

Certifications issued by the PRPV, dated 19 June 2020